Streamline your entire tax season by switching to online 2290 filing

Streamline your entire tax season by switching to online 2290 filing

Blog Article

Everyone knows that you can have a wonderful time with family and friends when you go on vacation or travel to a new and distant spot. However, sometimes disaster can arise when things don't go quite as planned or anticipated. Here are some tips and hints that would help ensure that your getaway is affordable and trouble-free.

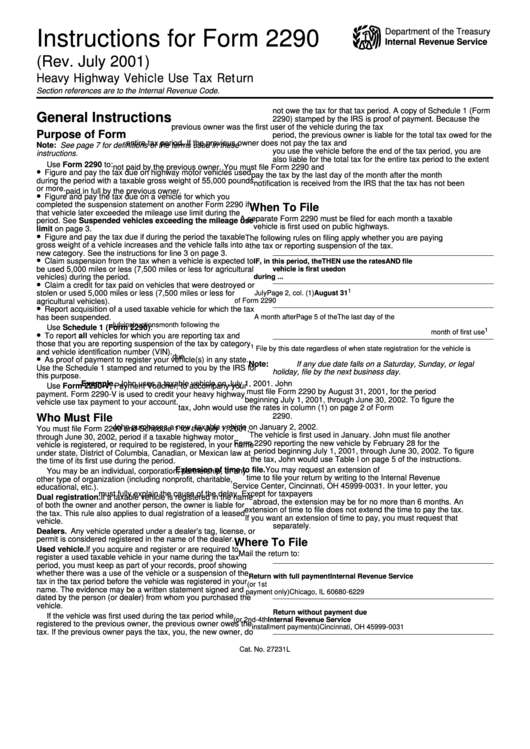

The 2290 tax form filing season officially kicks off in January but submitting returns too early can cause them to be incomplete. For example, if you performed contract work this year then your clients may issue a 1099 for payments made to you. If the statements do not arrive before you file it can cause underreporting of income and owing taxes. The best option is to confirm that the income on your books match the 1099's reported to the IRS. While waiting for tax statements to arrive, stay ahead of the game with good record-keeping. Although income tax forms and tax preparation software will be available at year-end, you must wait for the official opening of tax season to submit the return. You can check the date by visiting the Internal Revenue Service's website.

The Foreign Earned Income Exclusion allows an American expat to exclude up to $92,900 of income in 2011 using Form 2290 online 2555, with no tax on that income. The IRS 2290 filing exclusion is for the amount of salary, bonus, commission, or other earned income earned for services outside the USA, up to the limit each year. This limit for 2011 is the number of days during a qualifying period that are in the tax year times $254.52 per day.

4) Writing Good Quality Content: All you need is passion for your topic. Then create content for a website in a way that readers will enjoy and search engines will find and index your site! Web Content Writing if done right is by far the best thing you can do to build a successful home Internet business.

If you need an actual copy (rather than a transcript) of a previous tax return, you will need to pay $57 for each tax year requested. Fill out Form 4506 and send it to the IRS heavy vehicle tax address on the form. You can usually obtain a copy from the current year and the past six years. The copies can take up to 60 days to arrive. Making it a little challenging to complete your 2011 taxes without an extension.

Before operating the crane, operators should carefully read and understand the operation manual from the crane manufacturer. Further, they must always note any instructions given by a reliable instructor or operator. It is also crucial for the crane operator to understand the consequences of careless operation of cranes. They must be instructed of the proper use, prohibition and the safety rules and regulation during the operation.

Always stay alert when you are working in construction near any crane. If possible, avoid working under a moving load and stay clear of the counter balance. Always use your safety devices and helmet to avoid injuries. Safety is always the top priority of all workers and the crane operator.